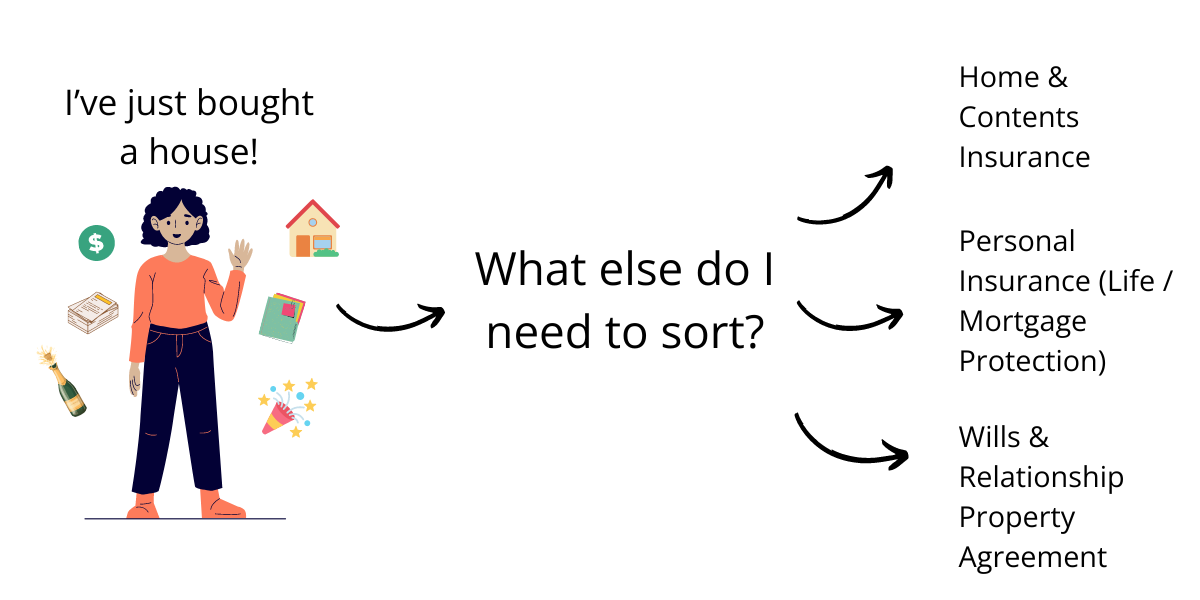

Congrats! Buying your first home is a huge achievement that comes with new responsibilities, including managing a mortgage. There are several other important considerations that come along with buying a home. This guide will help you navigate through these and prepare you for potential scenarios.

If you couldn’t work for a period of time due to an illness or accident, would you be able to keep paying the mortgage?

If you’ve purchased the property with someone else, do you have an agreement showing how much $ you each put in, who’s responsible for paying what, and what would happen if you broke up or needed to sell the property?

Have you got the right insurance covering the home?

Have you insured your stuff (contents)?

What would happen if you or the person you owned the home with passed away?

Insuring yourself

If your ability to pay the mortgage depends on your or your partner’s income, it’s crucial to consider what would happen if either of you couldn’t work due to an illness or injury. While ACC in New Zealand covers up to 80%* of your income if you’re off work for longer than a week due to an accident, it doesn’t cover illnesses. To help mitigate this risk, you should consider insuring a portion of your income or mortgage repayments.

What if the unthinkable happens?

The thought of passing away isn’t pleasant, but it’s important to consider the implications on your mortgage. If you or your partner were to pass away, would the surviving partner manage the mortgage repayments alone, or would they need to sell the house? Getting some life insurance can help provide a solution by covering some or all of the mortgage debt, ensuring the survivor can maintain the home.

Insuring your home + your stuff

Protecting your home (and the belongings inside it) is crucial. It safeguards against catastrophic events like floods or fires, as well as minor incidents such as accidental damage to personal belongings.

Hot Tip* - If purchasing house insurance online, ensure you’re insuring for the correct replacement value of rebuilding the home. Over-insuring can lead to unnecessary costs, as insurance companies only cover the rebuilding costs. Using an adviser can help ensure it’s done correctly, or by referring to online resources like CoreLogic’s Sumsure to estimate the rebuild cost correctly.

Legal bits – Wills and relationship property agreements

Relationship Property Agreements

Before finalising your house purchase, especially with a partner or others, it’s a good idea to establish a relationship property agreement. This document should detail each party’s financial contributions, and outline the process in case of separation or the need to sell the house.

Wills

Creating a Will is now more important than ever. It ensures your estate, including your share of the property, is inherited according to your wishes. You have the option to do this online if your situation is relatively simple. Or in more complex situations (and if you need to do a relationship property agreement at the same time), speaking to a Lawyer might be the most suitable option.

As a homeowner, it’s important to look beyond the mortgage, and consider some of the other responsibilities you now hold. Taking these steps can provide security and clarity for the future, so you can relax and enjoy your new home.

*Please note this information is general in nature and you should seek personalised advice to suit your unique circumstances.